CollectEarly™

Did you know 82% of small businesses fail because of cash flow issues? Optimize how you run your business with CollectEarly™ and get the tools you need to seamlessly bring your business finances in sync and get paid in four HOURS versus four weeks.

Benefits of FINSYNC:

- User-friendly platform so you can save time and get back to doing what you love

- Works with your current invoicing software

- Create an invoice, or drag and drop an invoice into FINSYNC

- Funds can get deposited into your synced WaFd account in hours

- Low 2.5% fee (less than fees to accept credit cards)

- For on-site jobs, utilize the ability to invoice and upload before and after photos on the spot to save you time matching jobs with photos

Hear How Our Clients Grow Faster

Ricky Gudino, owner of Caked Las Vegas, had a "game changing" experience with CollectEarly™ when FINSYNC and WaFd Bank partnered to help him get paid on invoices in hours instead of weeks.

“Partnering with FINSYNC and WaFd has been a revelation for my business. It's the perfect blend of technology and human touch that I value immensely, making them my go-to partners for success!”

Ali Megan Wagner, Owner of Pottinger Realty, LLC, Nogales, AZ

As a client of WaFd Bank, join the FINSYNC network for free!

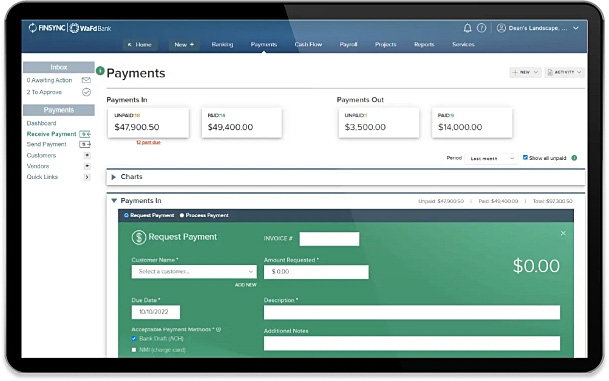

CollectEarly™ empowers cash flow so you can get paid in hours, not weeks, in four simple steps:

- Sync your WaFd business accounts to FINSYNC to see if you qualify

- Send an invoice to your customer using FINSYNC

- After your customer accepts the invoice, you have the option to CollectEarly™

- Funds can be deposited to your synced WaFd account in hours.

Cash Flow Management

Gain more over your cash flow, allowing you to seize growth opportunities to scale up your business, minimize financial risks, like economic downturns or late payments, and help your business stand the test of time.

- User-friendly, especially when connected with your WaFd business accounts

- See all bank and credit card activity in one place

- Visualize business cash flow with projections so you can plan for seasonality

- Plan for upcoming income and expenses with intuitive charts and calendars

- Better predict when funds will move into and out of the business

- Track profitability in real time

- Training and support resources are available with dedicated support representatives based in the US

Accounting Automation

Harness the power of automation to simplify your accounting processes and gain better insights into your business finances so you can get back to doing what you love, like having dinner with your family or going after your next bid.

- User-friendly platform to seamlessly bridge your accounting with your business operations

- Take the guesswork out of accounting with clear and concise workflows

- Make single or recurring journal entries

- Customizable chart of accounts

- Track income and expenses by department, location, and associate

- Cash and accrual reports

- Robust documentation retention to save you time hunting for files

- Transaction reports, audit trail, and more

Cost is 2.5% of the transaction amount—less than most credit cards. CollectEarly™ is an option available to FINSYNC clients using the Accounting & Cash Flow Management or Complete Solution plans. Some restrictions apply.