How to Write a Check

Filling out a check is one of those tasks you just don't need to do very often. If this is your first time writing a check, read our Complete Guide on How to Deposit and Cash a Check; it's got lots of need to know information on writing and depositing checks! If it's just been a while since you wrote your last check or you want to learn how, read on for a step by step guide.

Make the move to a Best Bank: WaFd Bank! Get all the things you've come to expect from banking with a *Free Checking account, including thousands of fee-free ATMs and personal financial management tools.

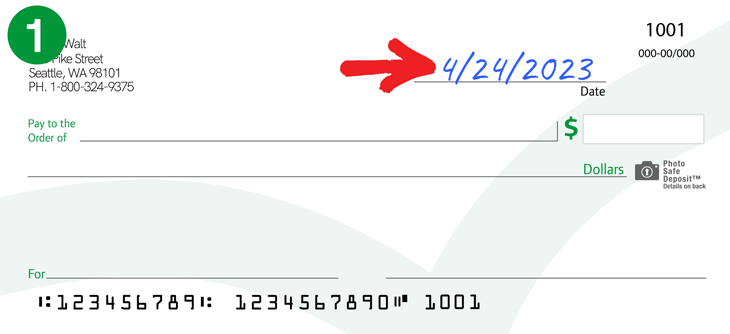

Open a Free Checking Account- Fill In the Date

Write the date in the top right corner of your check. This is so that the bank and the person you're paying knows when the check was written. And remember, when you give someone a check, even if you've dated it for some time in the future, it can still be deposited.![Image showing "4/24/2023" added to the date section of a check.]()

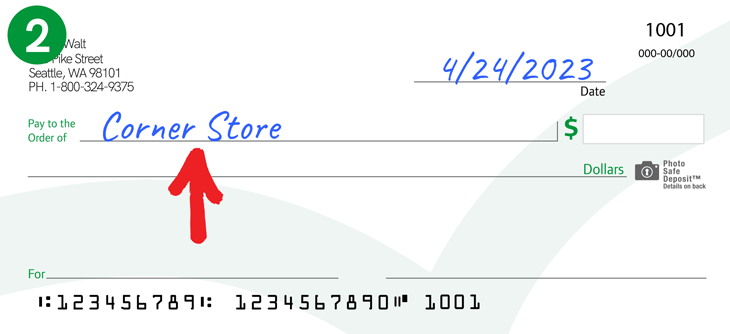

- Fill In the Payee (the Person or Company You're Paying)

On the "Pay to the Order of" line, fill in the name of the person or company you're paying. Before you start writing, always double check the exact name so you know what to write.![Image showing "Corner Store" added to the payee section of a check.]()

- Write the Amount in Numbers

There is a box just under the date line, meant for writing the amount of the check in numbers. If your check is for a whole number such as 50 or 75, always include the cents too so it shows as $50.00. It's always a good idea to include cents in all cases, such as $1,298.24. This keeps fraudsters from adding a few zeros to the number you wrote or changing any numbers.NaN/NaN/NaN

0.00

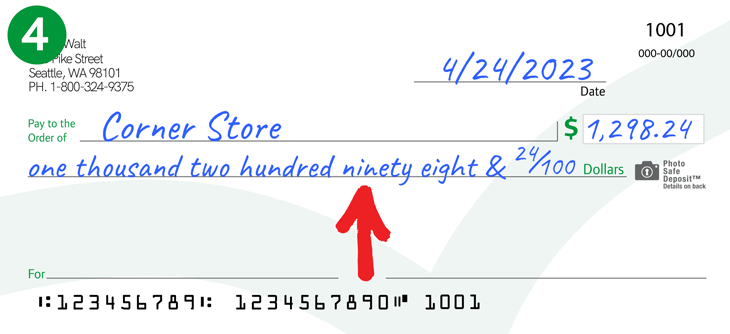

- Write the Amount in Words

Underneath the "Pay to the Order of" line you can fill in the amount of the check in words. For example, $1,298.24 would be written as: one thousand two hundred ninety eight & 24/100. If what you wrote in numbers is different than what you wrote in words, the bank will go with the amount you wrote in words.![Image showing "One thousand, two hundred ninety eight & 24/100" added to the dollars section of a check.]()

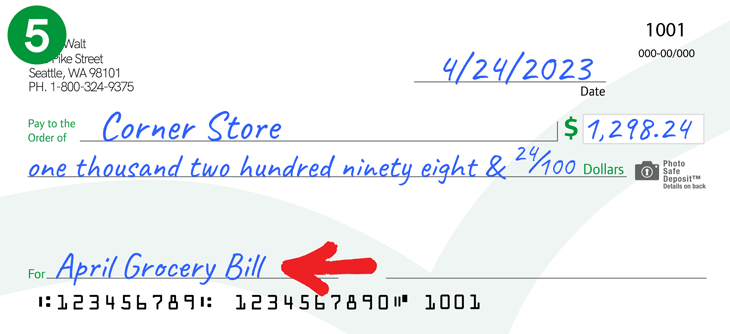

- Optional: Fill In the Memo Line

This is a good idea if you have a number that references what you're paying for, such as an invoice or account number. This way the company can refer to the check and make sure your payment is correctly accounted for (especially if you have a common first and last name). It can also be a helpful reminder of why you wrote the check if you ever need to reference how much and how often you've paid someone. Think the neighborhood lawn mower kid, or paying back money you borrowed from a family member.![Image showing "April grocery bill" added to the memo section of a check.]()

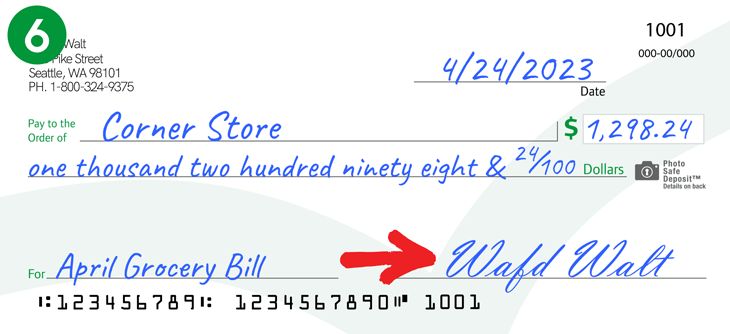

- Sign the Check

This is what makes your check valid and able to be cashed, so you never want to sign a check until every other detail has been filled in. If you wrote a blank check and lost it, anyone can write in their own name and deposit it.![Image showing "WaFd Walt" signature added to a check.]()

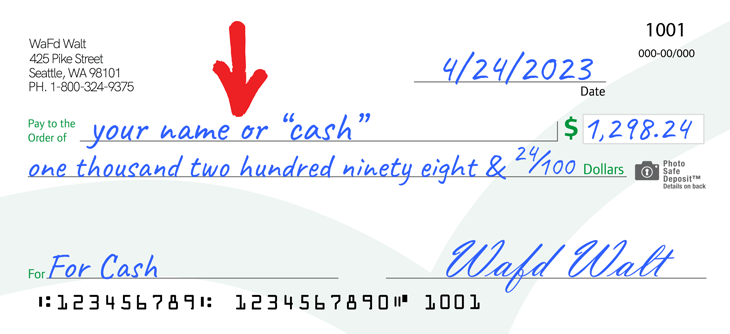

How to Write a Check to Yourself

Simply follow the steps above and include your own name in the payee line. You also have the option to write "cash", but if you lose or misplace the check whoever finds it can claim it and cash it for themselves. If you do lose a check, call your bank right away for help.

8 Things You Should Know Before You Start Using Checks

- When you give someone a check, even if you've dated it for some time in the future, it can be deposited and funds taken from your account. Never write and give someone a check if you don't yet have the money in your account.

- Always use blue or black ink pens. Other colors might not show up very well on mobile deposit, or not picked up at all when you deposit it at the bank (fun fact: they take pictures of the check too with a special scanner). Because of this, your check may be unreadable and will not be able to be deposited or it will be returned.

- Make sure the amount matches in both places on the check. If there is a difference between the numbers and the words, banks legally have to cash the check for the amount written in words.

- After writing the check amount in words (starting all the way to the left) draw a line through the rest of the space. This prevents someone from altering the amount you've written in words or numbers.

- If a check is older than six months, it is no longer negotiable and if you deposit it the check will be returned, meaning the funds will be taken back out of your account. If you write that check, you will need to write a new check if you still owe that money.

- Never sign the check until you've filled in all the details (and NEVER write "cash" in the payee line until you're actually cashing the check). If you sign the check and all other details are not filled in and you ended up losing the check somehow, whoever finds it can write in their own name and deposit it or cash the check at your bank.

- Try to keep your signature consistent. This way, if your checks do get stolen it will be much easier to prove which checks were written by you and which ones are fraudulent.

- Things happen—if your checks are lost or stolen, contact your bank to let them know. You may need to close your account and reopen a new once, since your account number is printed on each check. If you only misplace or lose a single check, you can just place a stop payment with your bank for a fee.

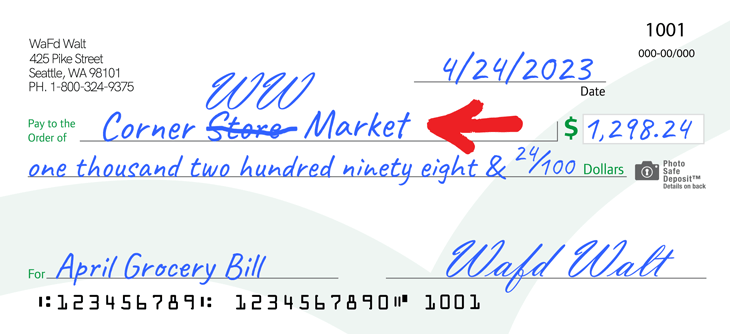

How To Correctly Make Changes to Your Check

If you made a small mistake on a check you're writing, do not use whiteout! Simply draw one line straight through your mistake, initial next to it, and then continue to fill out the rest of your check. If you make a mistake that seems to be inconsistent with other information on the check, you may get a call from your bank to verify this change was made by you, or it may simply be returned and then you'll need to re-write a new check or pay another way.

It's good practice to go back and double check the images of all checks you've written to make sure unauthorized changes have not been made. Images of checks you've written should be available to you in the transaction history in your online banking. If you do find something wrong on a check you've written, call your bank immediately for help.

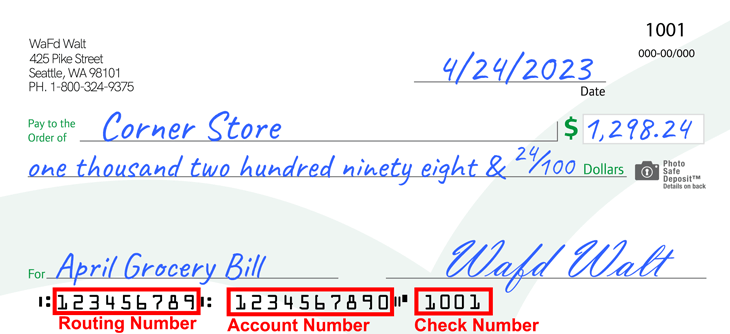

What the Numbers on the Bottom of a Check Mean

Each number is flanked by a special symbol on either end, called railroads. Your routing number is always listed first, your account number is second, and the third spot is the check number (also located in the top right corner). The account number and routing number are both used when you set up automatic payments, so if you have your checks handy you won't need to go online or call to get these numbers. That being said, it's a good idea to pay other ways to help keep your account secure.

Open an Account with WaFd Bank

Whether you're looking for a new checking or savings account, open it with WaFd Bank online in just minutes. From Free Checking to accounts offering rewards and interest, find one that fits your needs and get a great-looking debit card to boot. With services like Voice-Activated Banking, Zelle®, and Bill Pay, you'll see why WaFd Bank was voted Best Bank multiple years in a row.

Open a Free Checking AccountWaFd Bank is Here to Help

No question is too small, and with WaFd Bank you also have access to tools and services to help you manage your finances and get the most from your money. From checking accounts to savings accounts and everything in between, you'll find an account to fit your needs and your budget. Open an account online today or visit us at your neighborhood branch, give us a call at 800-324-9375, or check out what WaFd online banking has to offer.

*Nonsufficient funds charge may apply.

Content is provided for general informational purposes only and does not constitute legal, tax, financial, or business advice. Consult a qualified legal professional or specialist regarding your specific needs and circumstances.